FOREIGN TRUST WITH

U.S. JURISDICTION?

FRACTIONAL OWNERSHIP OF A FOREIGN ENTITY?

BEWARE!!!

The Tax Season for filing 2018 tax returns is now upon us and the full brunt of the Tax cuts and Job Act (TCJA) will occupy tax compliance by both the Taxpayers and the Tax Preparers. One of the most staggering provisions of the TCJA is the situation where your client owns an interest in a foreign entity directly or indirectly through a tiered-entity-structure, (TES).

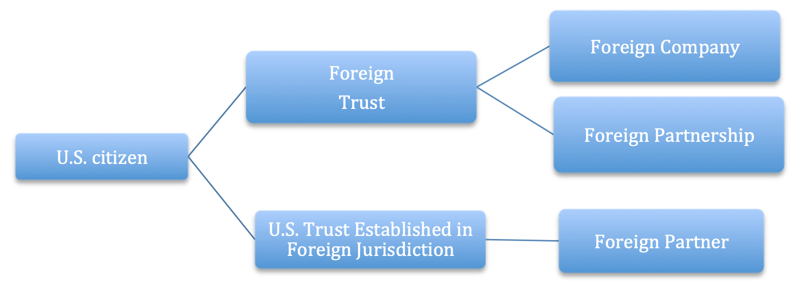

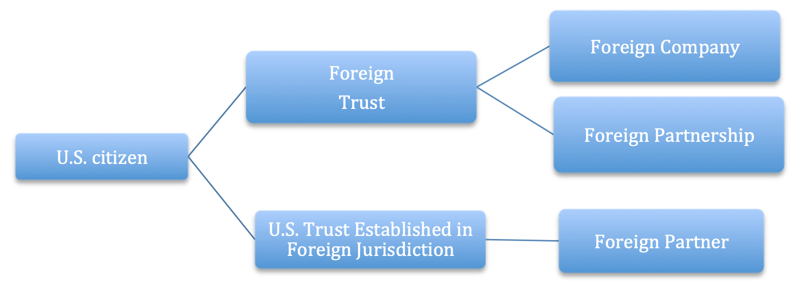

The above threshold test will certainly raise eyebrows and compel the additional questioning to determine if you or your client falls into this catch-all provision. A simple example of indirect ownership, TES, is as follows:

The above basic schematic shows how easy it has become to fall under this onerous tax and reporting requirement, which is quite confusing and complex. If you are under this provision then an immediate determination is needed to move forward for yet another ascertaining of whether you fall under the repatriation tax under TCJA. Many clients, and their tax advisors, are unaware of this obligation and you may have already failed to pay this tax and make the mandated filing.

The repatriation tax is on your accumulated earnings of a controlled foreign entity. For clients that own an interest in multiple foreign entities, the accumulated earnings may offset one another from each entity wherein the tax rates are 15.5% and 8%.

OWNERSHIP OF CONTROLLED FOREIGN CORPORATION:

The rules are complex, but in simple terms, if a U.S. person owns an interest in a controlled foreign corporation or owns any interest in a foreign corporation through a domestic corporation, they likely should have paid the repatriation tax beginning in 2017. A special election may be made to pay this tax in 8 installments.

DO YOU NEED TO BE A CORPORATION?

Additionally, an election under IRC Section 962 would treat an individual, trust or estate shareholder as a corporation to potentially receive more favorable tax treatment.

YEARLY ANALYSIS IS REQUIRED:

This analysis and election must be done each year. A controlled foreign corporation is a foreign corporation (some entities may be a corporation for U.S. tax purposes even if called something else!) where U.S. persons who own more than 10% also collectively own more than 50% of the entity (but note that the repatriation tax applies to any domestic corporation that owns a foreign entity). Constructive ownership rules apply and generally attribute stock ownership from family, entities, trusts and estates.

Although not changed by TCJA, many U.S. clients may be tempted to change their ownership in a foreign entity, but there are pitfalls here too. If you:

- Own 10% in a foreign entity, or

- Acquire 10% or more, or

- Reduce their interest below 10%, and

- Fail to report this to the IRS, yields a $10,000 penalty for each failure to report each situation involving changes as noted immediately above.

SUMMARY

If you think that this may be your situation, call us to advise and assist you. We are tax attorney professional ready to help.